How it works

Tracking Your Success

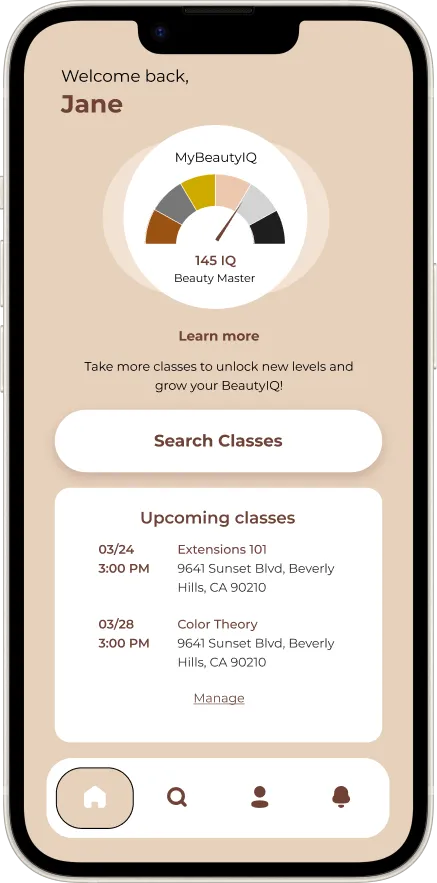

Using our algorithm, Beauty Pros and Educators can track their success. Our app has a meter of a user’s “BeautyIQ.” A user’s “BeautyIQ” level is determined by how many classes they have (a) taken if they are a “Student” or (b) how many classes they have taught if they are an “Educator.”

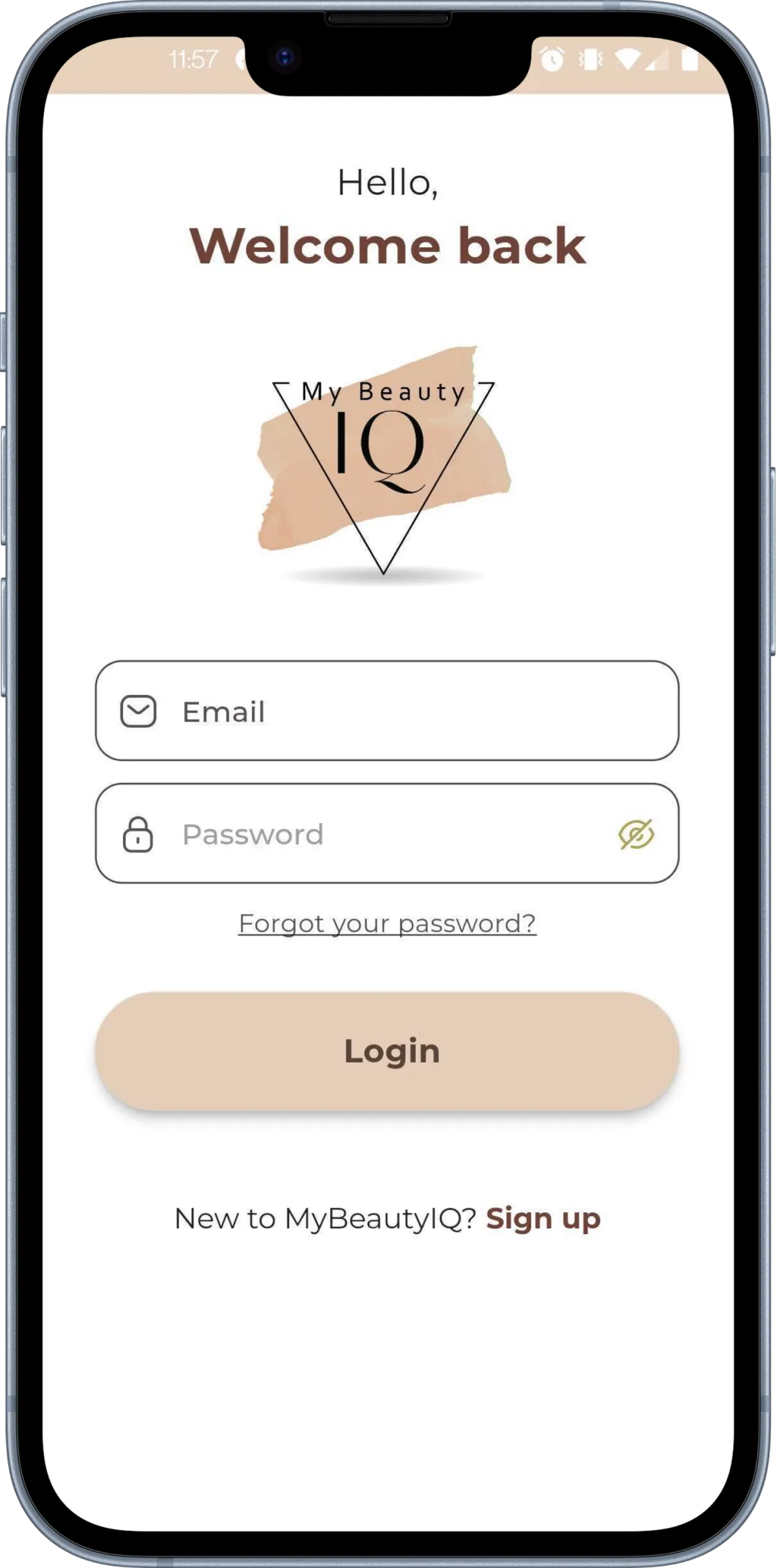

WHAT IS

MyBeautyIQ?

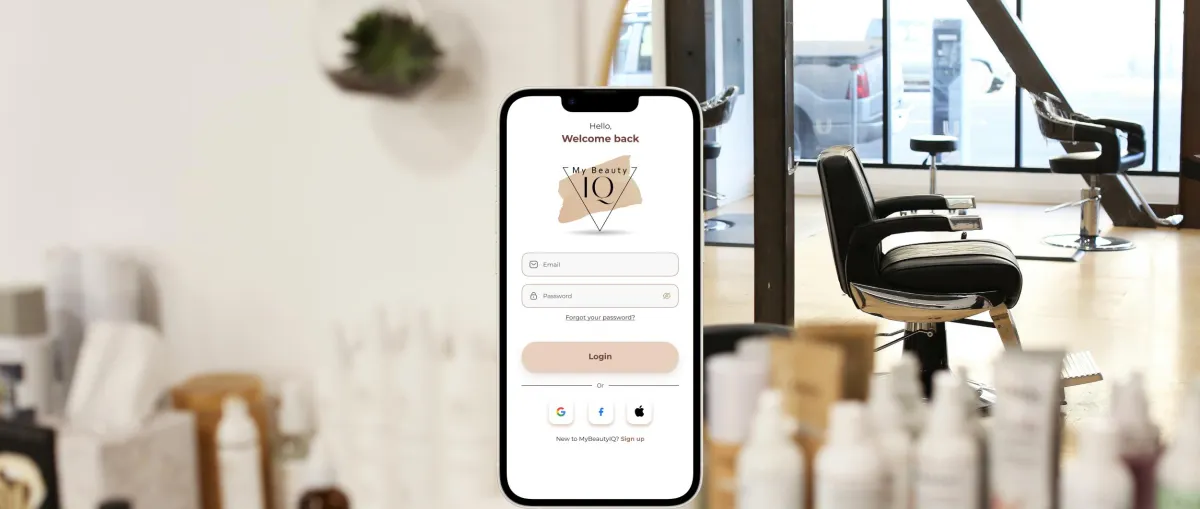

Announcing the launch of MyBeautyIQ, the

revolutionary app that makes in-person beauty education easily accessible to all industry professionals. With MBIQ Beauty Professionals, Educators, and Salon Owners will now have one centralized platform to go to for all of their in-person education needs. Find a class, teach a class, or host a class – all from the convenience of your phone!

MyBeautyIQ empowers all Beauty Professionals and builds community through its centralized app. Educators can easily list a class, reserve a venue, and sell tickets to a built-in audience. Beauty Professionals can seamlessly search and register for classes, and Salon Owners can rent out their space to host classes.

ADVERTISE

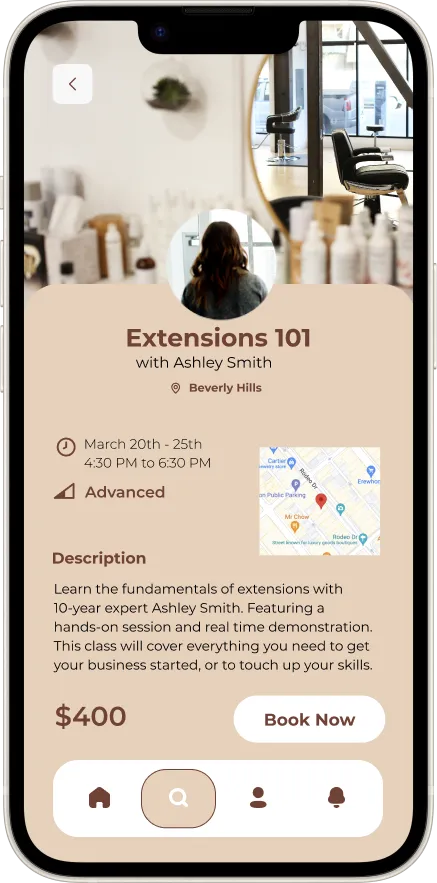

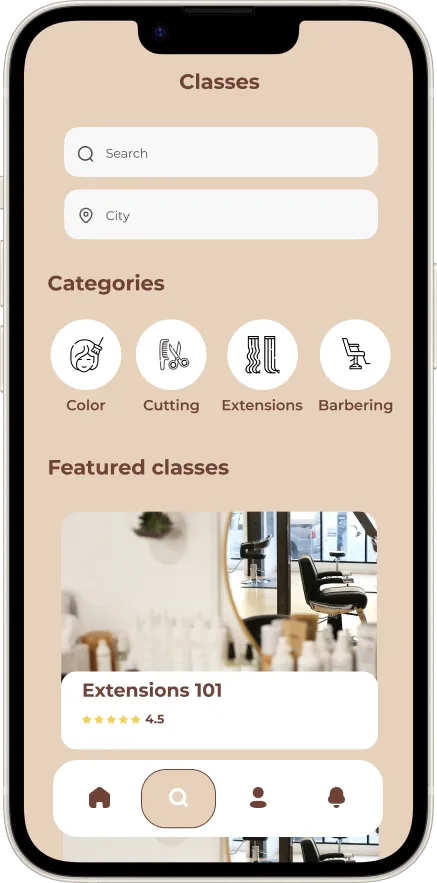

Find Classes

The “Students” page will display when they are looking for classes to take. The top contains a search bar to search by location. The user can type in a city, state or click on the “pinpoint location icon” to have the app access their phone’s location and find classes nearby. The user can filter classes by date and subject. They can also filter by Class Type “Look ‘n Learn” – watching the instructor, “Hands On” – working on live models or doll heads. “Educators’” classes can be advertised on this page to highlight/spotlight them for “Students.”

Students

Become a Student on MyBeautyIQ. Search, sign up for, and enjoy classes near you!

Educators

Become an Educator on MyBeautyIQ. Post, promote and sell your class tickets to an audience of beauty professionals looking to take a class like yours!

Salon Owners

Salon Owners can rent out their salon space on MyBeautyIQ to host an educator’s class!

MyBeautyIQ ©2025